IDC Report shows 53% YoY growth in sales in India’s Wearable Market

International Data Corporation’s most recent comprehensive data reveals smart wearable shipments have witnessed an impressive 53% increase in sales over the previous year. The first half of this year has seen 57.8 million smart wearable devices being shipped to India. If we were to talk about smartwatches, IDC says that different shapes, designs, and materials finishes with new features have resulted in 128.6% YoY growth.

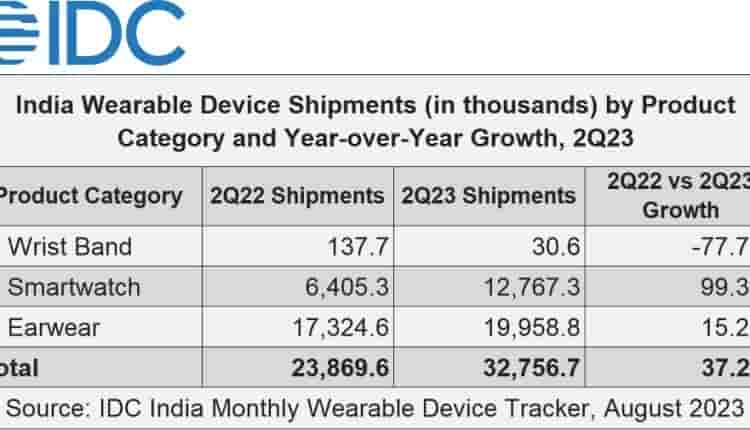

In the second quarter of this year, 32.8 million wearable devices were shipped, which shows 37.2% YoY growth and 30.6% QoQ growth. On one side where smartwatches shipment almost doubled to 12.8 million in 2Q23 on the other hand, the average selling price of smartwatches declined by 44.9% in 2Q23. It’s not only about the smartwatches but wearables have seen a drop in ASP from US $26.7 to US $21.0.

Coming on to the earwear category, TWS’s share has increased by 52.9% YoY while neckbands declined by -22.5% in 2Q23. The ASP of TWS has declined by 15.3% whereas neckband ASP has declined by 6.4%.

Wearable company’s market share

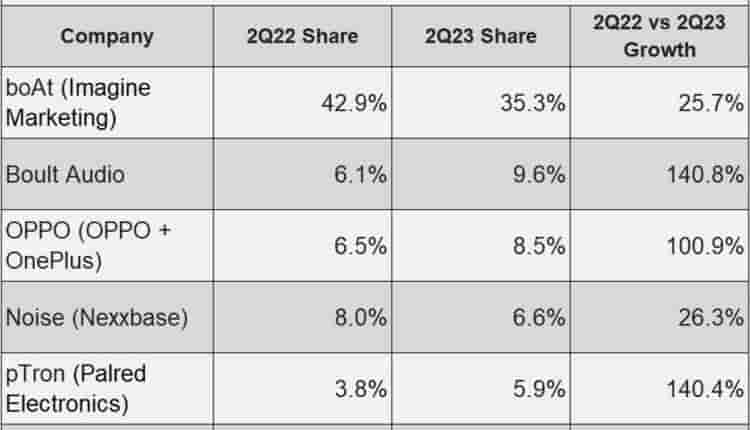

Indian company boAt holds the first position with a 26.6% market share, growing by 6.5% YoY. Earwear has been its core identity that accounts for 77.7% of its shipment in 2Q23 and in the TWS segment, it leads with 35.3% share.

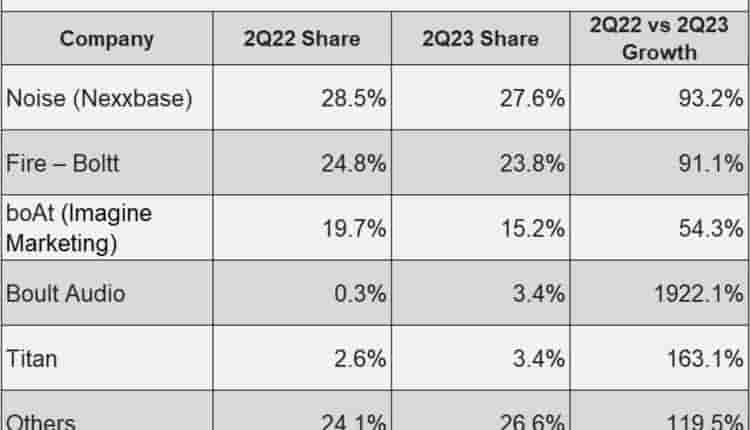

Noise, another Indian brand, holds the second position in overall wearables. It has seen a growth of 61.6% YoY with 13.5% market share. Noise regained its first position in smartwatches with a 27.6% share, growing by 93.2% YoY. It has also moved ahead in the TWS segment with a 6.6% share, growing by 26.3% YoY.

Now comes the Chinese brand Oppo which holds the third position in market share with a market share of 10.7%. It holds the third position in TWS with an 8.5% share. A large fraction of its shipment is held by Bullet Wireless Z2 and TWS Nord Buds 2 with more than 75% share. Then comes the Fire-Boltt, Boult Audio, and other wearable brands.

Fire-Boltt holds fourth place with a 9.5% share of the market whereas Boult Audio holds fifth with a 6.6% share. Fire-Boltt has witnessed a 91% growth YoY while Boult Audio has witnessed 176.9% YoY growth. Fire Boltt has dropped to the second position in the smartwatches category with a 23.8% share, growing by 91.1% YoY. Other brands of wearables include pTron, and Mivi with 5.9% and 4.5% share respectively.

Indian wearable brands have a strong hold on the Indian market with stylish yet affordable products that give cutthroat competition to other international brands in India like price-sensitive markets.