UIDAI Deactivates Over 2 Crore Aadhaar Numbers Belonging to Deceased Individuals: Also Encourages People to Report the Death of Family Members

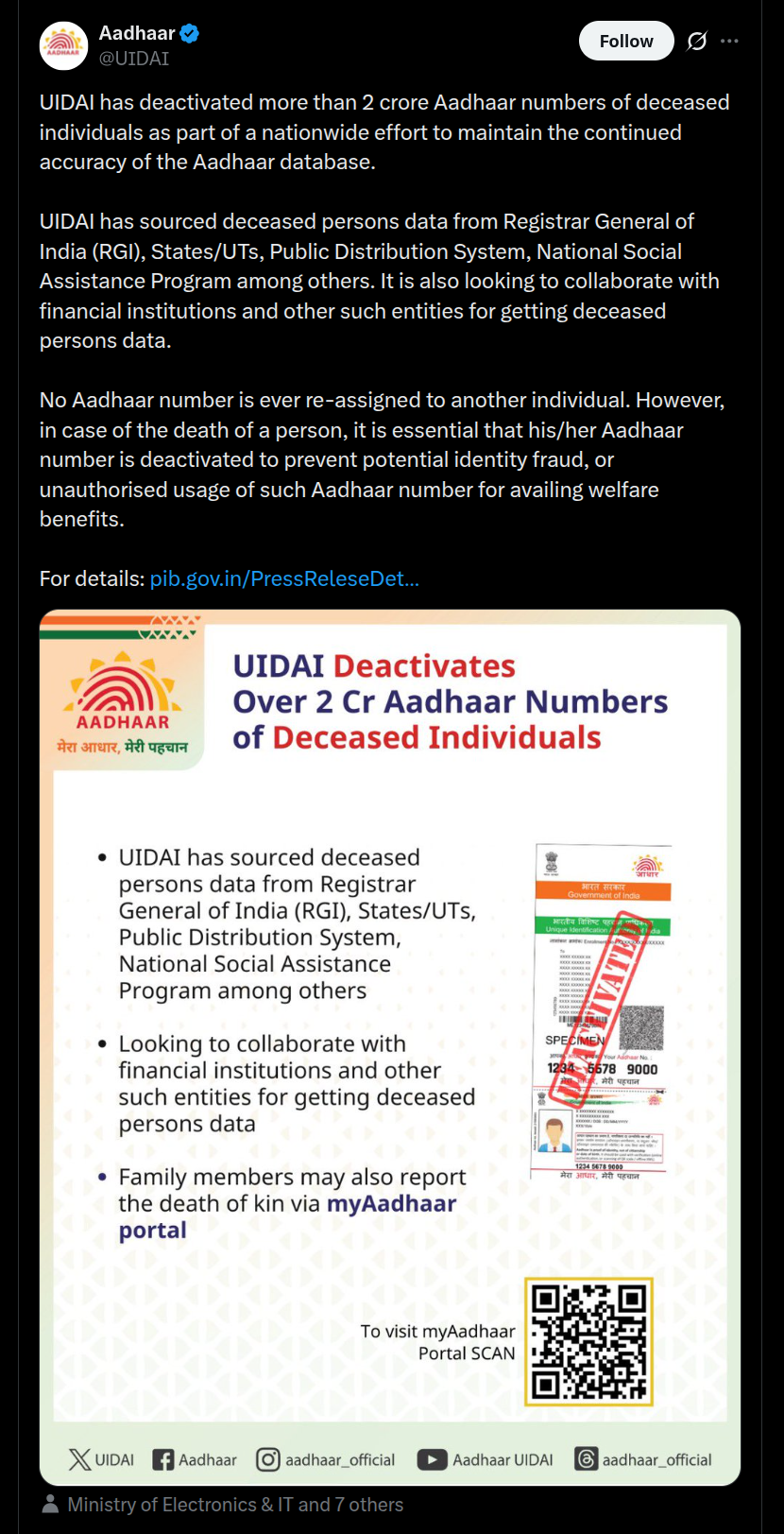

The Unique Identification Authority of India (UIDAI), as part of a nationwide clean-up effort for maintaining accuracy of its Aadhaar database, has now deactivated over 2 crore Aadhaar Numbers of deceased individuals. In addition to this, the authority also asks its card holders to report the death of their family members, along with the necessary document details, in order to continue maintaining the Aadhaar database accuracy.

Here’s more about it.

UIDAI – Over 2 Crore Aadhaar Numbers of Deceased Individuals Deactivated

As mentioned, UIDAI recently deactivated over 2 crore Aadhaar Numbers of deceased individuals, relying on the data sourced from the Registrar General of India (RGI), States and Union Territories, Public Distribution System, National Social Assistance Program, and more. In the future, UIDAI is also planning to collaborate with other financial institutions as well as other similar agencies in order to collect the details of deceased individuals. While Aadhaar Numbers are never reassigned to others, the goal of this initiative is to prevent possible fraudulent activities such as identity theft and unauthorized usage to gain privileges like welfare benefits and more.

It should also be noted that UIDAI is also encouraging its Aadhaar card holders to report the death of family members and for this, UIDAI had introduced a facility on the myAadhaar Portal early this year in 2025. People from 25 states and union territories that use the Civil Registration System can access it, and the expansion to the other states and union territories is underway. The death of family members can be reported by providing his/her Aadhaar Number and Death Registration Number, after verifying the identity of the person reporting it. Following the submission, the request will be validated and the necessary action will be taken.

Speaking of a few other related updates, RBI (Reserve Bank of India) and NIPL (NPCL International Payments Limited), in collaboration with the European Central Bank, had officially announced the UPI-TIPS interlinkage recently with the aim of providing an enhanced cross-border payment facility across the Euro area. Furthermore, India has also brought out its new E-Passport system too, this month in November 2025.

Stay tuned for more updates.