Indian smartphone market reached a five-year high in the festive Q3 of 2025, market grows 4.3% YoY; IDC report

According to a recent report by International Data Corporation (IDC), the Indian smartphone market has hit a five-year high in the festive Q3 of 2025, with a 4.3% YoY growth. It is said that this growth was driven by strong demand for premium smartphones, supported by both new launches and previous-generation models.

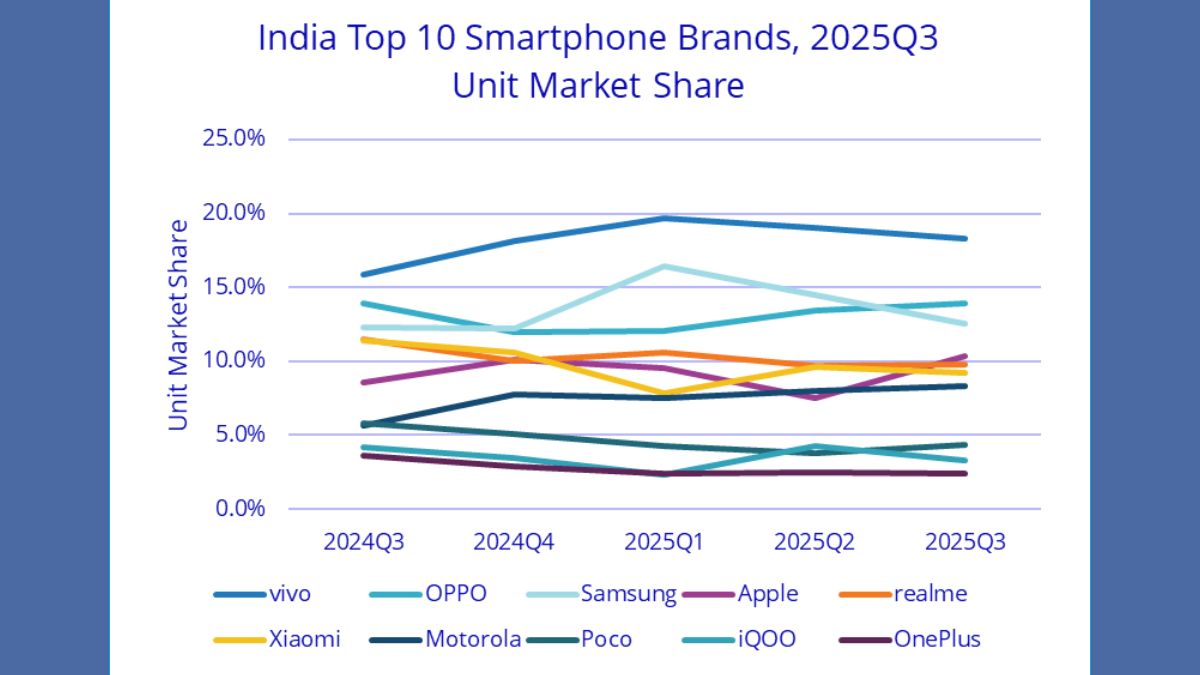

Among the top 10 brands, Apple recorded its highest-ever quarterly shipments in India, reaching 5 million units and securing the fourth position in the market for the first time. The brand witnessed a 25.6% YoY growth. Vivo retained the top position, Oppo was at the second spot, while Motorola recorded the highest YoY growth at 52.4%.

The report revealed that the entry-level segment witnessed the growth of 35.3% YoY. Xiaomi, Realme, and Vivo led the category, together accounting for over 50% of shipments. The mass budget segment declined 8% YoY, and brands like Oppo, Vivo, and Realme dominated this segment. The entry-premium segment saw a 4.9% YoY decline in shipments; brands like Vivo, Oppo, Samsung, and Motorola led this category. The mid-premium segment grew 10.7% YoY. Samsung, Oppo, and OnePlus dominated this segment. The premium segment recorded robust growth of 43.3% YoY, while the super-premium segment posted the highest growth of 52.9% YoY.

Apart from this, the Qualcomm-based smartphone shipments grew 17.9% YoY, and the growth was driven by Xiaomi/POCO/Nothing devices. The offline channel continued its growth in this quarter with shipments rising 21.8% YoY, while the online channel share declined to 43.6%.

“Aggressive festive promotions and flexible financing options drove strong shipment volumes in Q3 2025. However, consumer demand remained concentrated in the premium segment, leaving the mass market under pressure and resulting in a significant inventory build-up heading into Q4 2025,” said Upasana Joshi, senior research manager, Devices Research, IDC Asia Pacific. “This surplus has been further exacerbated by rising component costs—particularly in memory—and currency fluctuations, prompting brands to raise prices post-Diwali. As a result, IDC forecasts a year-over-year decline in shipments for Q4 2025, leading to an overall annual contraction, with total smartphone shipments expected to fall below 150 million units for the year.”