Indian smartphone market grew marginally by 0.5% YoY to reach 152 million units in 2025; Nothing emerged as the fastest-growing brand in 2025

The International Data Corporation recently revealed the Indian smartphone market shipment results for 2025. According to the report, the market grew marginally by 0.5% YoY to reach 152 million units. Shipments rebounded during the mid-year quarters (2Q-3Q25) before easing again in the final quarter.

The offline channel recorded its highest shipment levels in the past six years, growing 12% YoY and expanding its market share to 57%, up from 51% in 2024. In contrast, the online channel’s share declined to 43% from 49%, with shipments falling 12% YoY.

“Despite stagnant shipments in a challenging 2025, India’s smartphone market delivered a strong 9% year-over-year value growth, driven by continued premiumization across both new and older flagship models. Looking ahead, IDC expects volumes to contract in 2026 amid an unprecedented global memory shortage. However, sustained premium demand and finance-led purchasing are likely to support value growth even as shipments soften. Recent price increases in the Android ecosystem also point toward market consolidation, where scale will be critical for vendors to secure supply and manage pricing,” said Upasana Joshi, Senior Research Manager, Devices Research, IDC Asia Pacific.

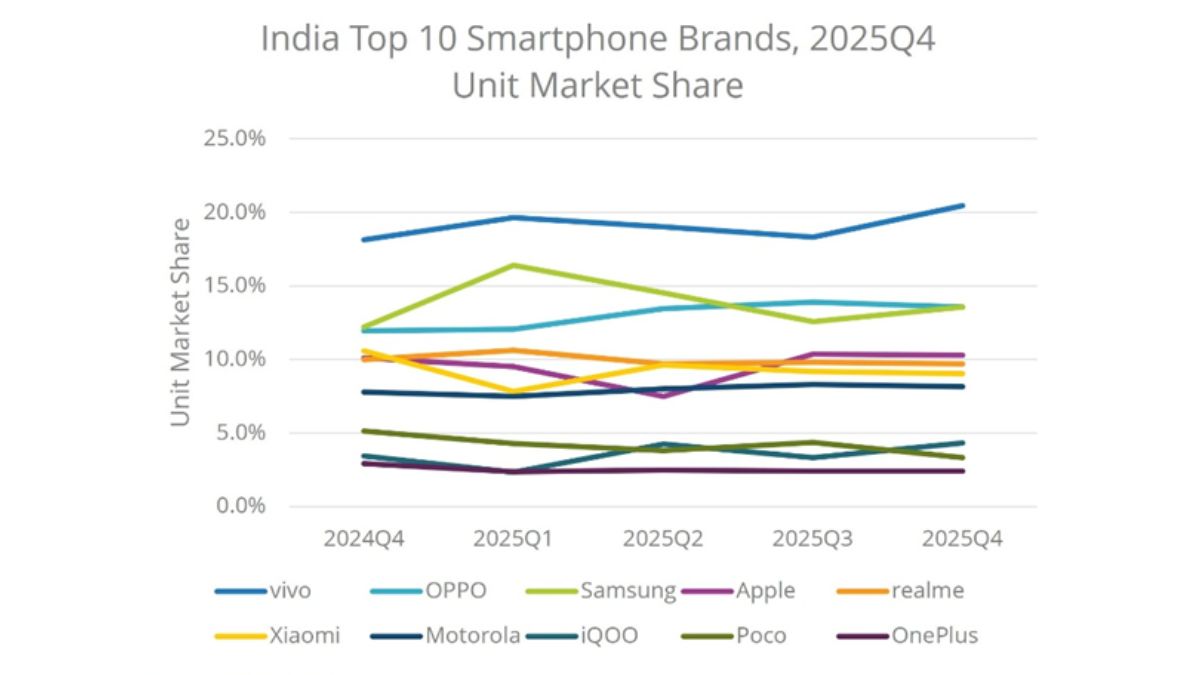

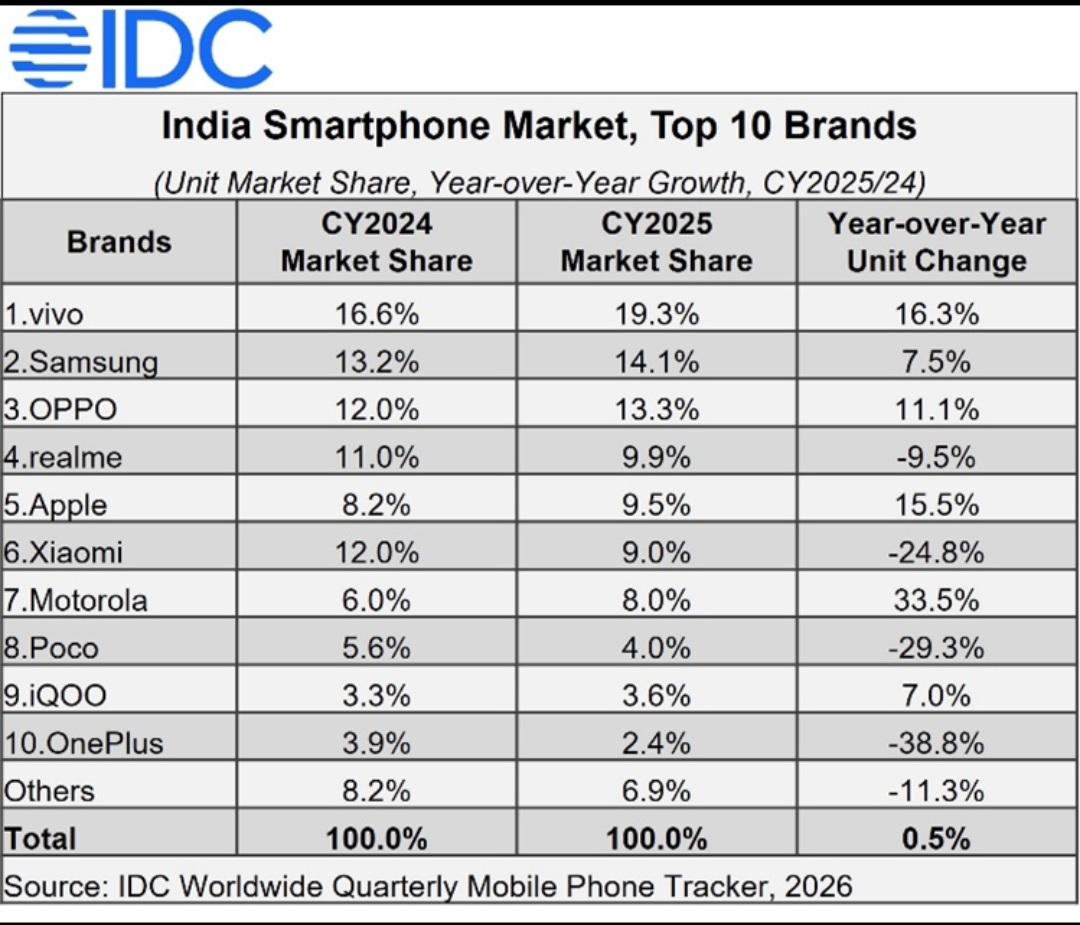

Top 10 brands in 2025

Vivo, Samsung and Oppo have dominated the smartphone industry in the country. Xiaomi’s market share declined, brands such as Realme, Motorola and iQOO capitalised on the shift to improve their rankings. India remained Apple’s fourth-largest global market in 2025 as the company reached a record 14 million shipments in the country, growing 16% YoY. Apple ranked 5th in India’s overall smartphone market with a 10% volume share.

POCO, iQOO and OnePlus were at the eighth, ninth and tenth positions. It is also revealed that Nothing emerged as the fastest-growing brand in 2025, posting a significant 45% YoY increase.

Segment-wise shipments in India

- The entry-level segment (sub-US$100) grew strongly by 18% YoY, expanding its share to 16% from 14% a year earlier. Xiaomi and Vivo have led this segment, while Motorola recorded the fastest growth in this segment.

- Shipments in the mass budget segment (US$100-US$200) declined 8% YoY, reducing its market share from 44% to 41%. Vivo, Oppo and Motorola gained share in this segment.

- The entry-premium segment (US$200-US$400) registered a 5% YoY decline in shipments, with its share easing from 28% to 26%. Brands like Vivo, Samsung and Motorola posted strong growth in this segment.

- The mid-premium segment (US$400-US$600) expanded 23% YoY, increasing its share from 4% to 5% in 2025. Apple led the segment, followed by Samsung and Oppo.

- The premium segment (US$600-US$800) recorded the fastest growth at 37% YoY, with its share rising from 4% to 5%. Apple dominated the category with a 74% share.

- The super-premium segment (US$800 and above) grew 7% YoY, with its share steady at 7%. Apple maintained leadership with a 63% share, while Samsung’s shipments increased by 1.8x, lifting its share to 34%.

If we talk about Qualcomm and MediaTek device shipments, Qualcomm-based smartphone shipments grew 23% YoY in 2025, increasing their market share to 30%. The growth was driven by strong shipments of Xiaomi, POCO, Oppo and Nothing devices. While MediaTek’s share declined to 46%, down from 54% a year ago, following a 15% YoY drop in shipments.